Don't be negative about your finances.

A lot of people give up after a week or two of trying a budget because all they can see is their whole pay disappearing. They can no longer spend whatever whenever and feel too restricted and controlled when they feel entitled to spend their hard earned pay anyway they like. When in fact you will feel more negative as your domestic finances continue to spiral out of control. Read article #1 for more on this topic 'Why do you overspend?'.

Think positive.

You're not going to stick to your savings, let alone the budget if you're still negative about your finances. Look at the big picture. Not what you're missing out on now, but what you will achieve by sticking to your plan. Think about yearly amounts to understand what you're capable of.

I could share with you, 20 tips and tricks where and how to save money but if you have 20 to go through, you're more than likely going to lose interest in that. Imagine trying to implement so many savings ideas, especially if just starting out?... Too much to remember and too hard to keep track of them all.

This is why I have only included my 5 favourite ways. They have the potential to save you more than just loose change.

They are almost too easy!

If you're finding it impossible to save any money as your pay will not stretch that far, try these easy tricks to save small amounts often to equal $1000 or more a year without really noticing.

Keep savings amounts separate to your other money, either in another bank account or stash these amounts in separate envelopes or bank coin bags.

If you have a few savings ideas on the go, keep them separate from each other too by using different envelopes. You can watch each one fill up & know what each one will be used for.

That to me = Stress free!

#1

Basic $20 a week stash

Knowing the simple sum of $20 x 52 weeks = $1,040 is enough to make you stash away $20 each week for one year to cover something extra. A small debt or Christmas presents needing to be purchased that always sneak up on us.

$20 is an easy amount to start with. After a few weeks you wont even miss that $20 and how good will it feel to have $1,040 after 52 weeks?

This will make you feel more positive, to keep going every year as a habit.

#2

Round down trick

When ever you make a purchase, or even just once a week, log in to your online banking and move the loose dollars and cents to a separate savings account. Round all accounts down to the nearest $1 $5 or even $10 if you're able to.

Moving small amounts like this often will add up very quickly. This is an easy way to save up to $1000 each year if transferring a few times each week.

There are iOS Apps available to do this automatically for you. Each time you use the account you've linked, it will use the cents up to the nearest $1 and then sends these cents to your investment account, quietly building in the background. You can withdraw your investment back to your bank account at any time.

You do have to link your bank accounts for these apps to work but as they are automated, you can set and forget!

The most trusted one in the app store is RAIZ to Invest your spare change. I can recommend this one as I have been using it. It slowly grows my money cents at a time. I'll use this savings plan for the distant future as I've set it to forget it.

Check out the app and what it offers HERE

#3

$2 Coins in a 750ml bottle

I read a while ago that you could fit $1000 worth of $2 coins into a 500ml bottle, but it seems to only hold around $800 so I thought I would test it out myself using the next size up 750ml Pump bottle.

This little beast does in fact hold $1000

With a tiny bit of room at the top for possibly another $30

Throw all of your $2 coins in one of these to save another $1000 on the side. Watch it get to the top, knowing how much it will be at the top - inCENTive!

#4

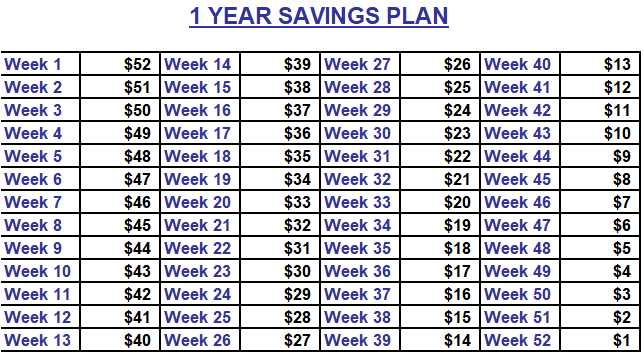

52 week saving plan

This one can be kind of fun to keep track of as the amount changes each week as you follow the chart.

Week one you will put away $1

Week two you put away $2 ...and so on.

The highest amount is only at $52 at the very end, Easy!!

If you begin this plan in the first week of the year, the high amount will be needed by Christmas time when you'll need every dollar you can get so maybe do what I do...

I like to reverse this one and start at $52 and ending with $1 at week 52 (making December bills easier to pay).

Watching the chart backwards, you can also see how many weeks left until the end of the year and as Christmas approaches you, like a warning count down.

Saving these amounts, you will have $1,378 in total!

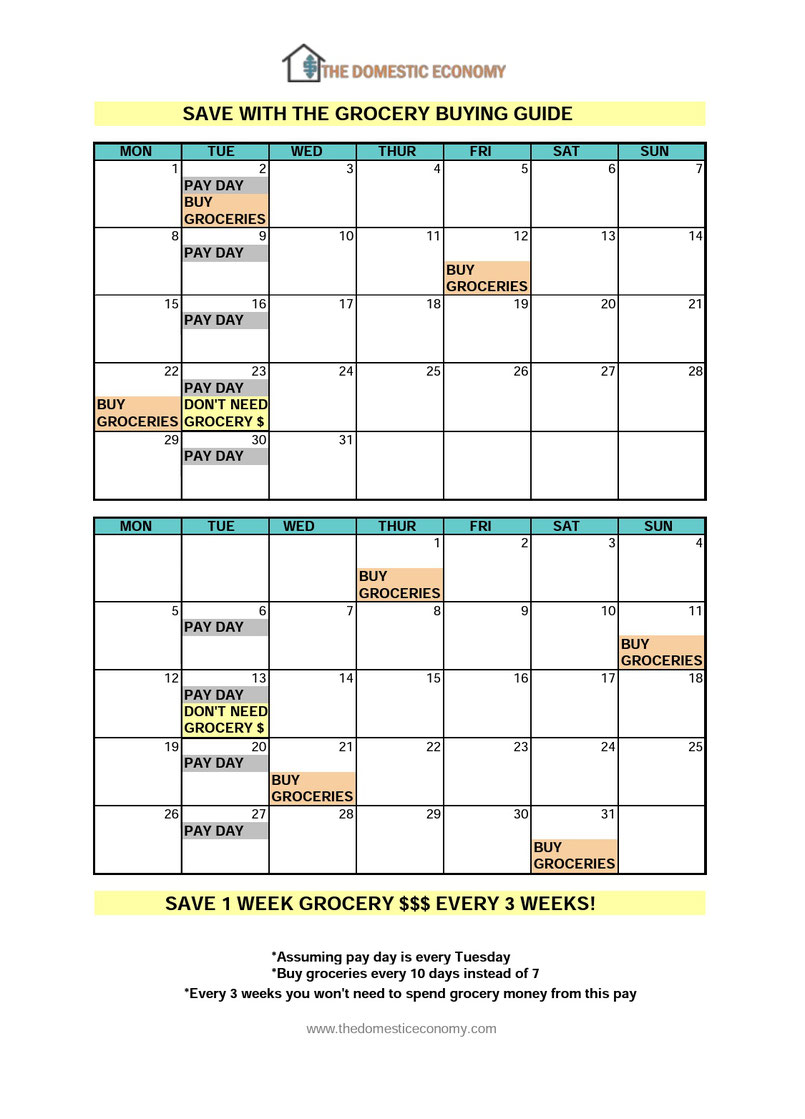

#5 Stretch the groceries a few days to overlap amounts

Let's face it, everyone has things in their pantry to use up to be able to stretch out the grocery shop day. Get frugal with your meals. Try different recipes using less types of ingredients.

Try some recipes from the well known 4 INGREDIENTS cookbook to make your supplies last a few more days. It's a great recipe guide using only 4 ingredients per recipe. Highly recommended.

You only have to follow this chart below (alter it to suit yourself as to how many days further you stretch out the shopping day) to save a whole grocery amount, every 3-4 grocery times.

You have to be flexible with this one and do your groceries on different days of the week each time. If you can do this, it's a sneaky way to overlap your grocery money needed and keep one when it doubles up!

My favourite way to 'free' up a chunk of cash:

1. Put your average grocery amount away each pay.

2. Hold onto until you need to do groceries.

3. Instead of weekly, do groceries every 9 or 10 days.

4. Every 3-4 groceries you will end up with two amounts put away for this; one amount to do the groceries and one amount to save or pay off some debt.

...If your groceries are like mine at $400 each fortnight, you can save up to $2,500 a year.

You can adjust the amount of days by 2 or 4 but I find 3 days over is just do-able. You don't want to make it too hard.

Keep it achievable.

If you can spare a little money in your budget for even just one of these ideas, you have the potential to pay off some small debts, credit cards or save money for something you and your family have needed. What about an emergency fund for unexpected expenses? If you have that one saved first, it won't interrupt your future savings by not making the savings possible. Those unexpected ones can ruin plans, so don't let them!

Implementing all 5 into your budget if you can spare approx. $100 each week, you can save $5,000+ every year.

If you can only fit one or two ways into your budget, remember each one can quietly save you $1000+ on the side and might be an incentive to add another one into budget.

After all, each one will be an average $20 each week.

These are the easiest and best ways to save without really missing the small amounts!

Write a comment